Actualités ac261/1099

1099 vs. W-2 Employees: Which Is Best for Your Business?

Mon, 27 May 2024 17:00:00 GMT

If your small business is ready to hire extra help, you have two options to consider: 1099 workers or W-2 employees. These two classifications refer to the respective IRS forms employers are required ...

What Is a 1099 Form and What Should You Do With It?

Thu, 24 Oct 2024 01:12:00 GMT

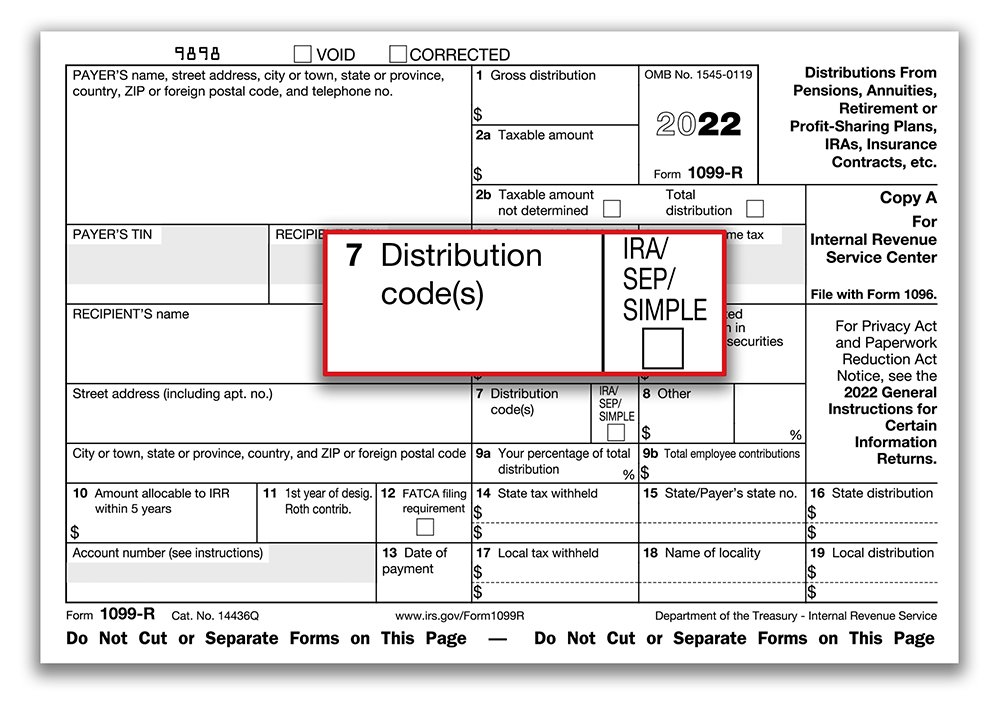

Form 1099 reports freelance payments, income from investments, retirement accounts, Social Security benefits and government payments, withdrawals from 529 college savings plans and health savings ...

When IRS Forms 1099 Are Wrong Or Missing

Mon, 06 Feb 2023 06:32:00 GMT

Robert W. Wood is a tax lawyer focusing on taxes and litigation. Closeup of Form 1099-K, Payment Card and Third Party Network Transactions, an IRS information return ... [+] used to report certain ...

1099-K: What You Need to Know

Wed, 22 Feb 2023 16:00:00 GMT

IRS Form 1099-K gets a lot of attention each tax season. Thatãs in part because the 1099-K form is used to report certain payments from payment cards and third-party network transactions.

Paypal 1099-K: How PayPal 1099-K reporting works

Wed, 09 Oct 2024 08:13:00 GMT

Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more.

1099 Information

Sat, 13 Oct 2018 15:44:00 GMT

A 1099 contains important tax information, which is also being reported to the Internal Revenue Service. If you received a 1099 form, the State of Maine's records show that you were paid money during ...

What is Form 1099-B: Proceeds from broker transactions?

Sun, 09 Aug 2020 16:49:00 GMT

If you sell stocks, bonds, derivatives or other securities through a broker, you can expect to receive one or more copies of Form 1099-B in January. The 1099-B helps you deal with capital gains ...

Ticketmaster 1099-K: A guide to 1099-K reporting for sellers

Thu, 10 Oct 2024 05:37:00 GMT

For the 2024 tax year, you should get a Form 1099-K from Ticketmaster if you receive more than $5,000 from reselling tickets through them during the year. You're only taxed on the profit you make ...

IRS Form 1099-K: When You Might Get One From PayPal, Venmo, Cash App

Sat, 24 Dec 2022 01:55:00 GMT

IRS 1099-K reporting requirements have caused a lot of confusion. Thatãs mainly because of changes to a federal tax reporting rule that requires third-party payment networks, including apps and ...

This IRS Form 1099 Is Not Counted As ãIncomeã By IRS

Thu, 16 Jun 2022 07:14:00 GMT

Robert W. Wood is a tax lawyer focusing on taxes and litigation. IRS Forms 1099 allow computer matching of Social Security numbers and dollar amounts paid. That makes it possible for IRS ...

What Is a 1099 Form and What Should You Do With It?

Sun, 27 Oct 2024 15:39:00 GMT

But if you do any self-employed or freelance work, you may receive 1099 forms from each of your business clients reporting the income they paid to you. Anyone who received income from investments ...

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)